Investing for a better future

As an institutional money manager, we take a long-term perspective in our duty to act in the best interests of our clients. In this fiduciary role, we aspire to the following:

High PRI Assessment Scores

We strive to achieve the highest possible scores across assessment modules.

Direct ESG Engagements

An active shareholder, we directly engage in ESG activities with companies across a broad range of industries.

Proxy Voting Activities

Since 2008, we have supported over 750 shareholder proposals related to a wide range of environmental and social issues.Achievements and Initiatives

- PRI signatory since July 2008. TDAM was the first Canadian bank-owned asset manager to sign the United Nations Principles for Responsible Investment (PRI).

View the 2020 RI Transparency Report for TDAM and TD Greystone* - CDP signatory, including CDP Climate Change, CDP Forests, and CDP Water. CDP's mission is to see a thriving economy that works for people and planet in the long-term.

- Canadian Coalition of Good Governance (CCGG) participant. The CCGG promotes good governance practices in Canadian public companies and the improvement of the regulatory environment to align the interests of boards and management with those of their shareholders.

- One of twenty institutional investors across the globe to take part in a pilot project conducted by the United Nations Environment Programme - Finance Initiative (UNEP FI) with the goal of assessing how climate change and climate action could impact investor portfolios around the world. Learn more

* TD Greystone Asset Management (TD Greystone) legally amalgamated with TD Asset Management Inc. (TDAM) on November 1, 2019.

ESG Engagement Committee

Comprised of seasoned professionals bringing diverse expertise such as legal, external distribution, investment management and risk.

The committee oversees our ESG framework, engagements, proxy voting decisions and annual PRI reporting.

Our TD Sustainable Investing Framework was established in 2009.

ESG Integration

ESG integration is about using research, data and insights to inform investment decisions. We believe that ESG factors are an important consideration within our investment process, helping to provide us with a more robust view of potential risks and opportunities.

How we integrate ESG factors into our investment process

For private market investments, ESG risks are reviewed on an asset-by-asset basis and at the aggregate portfolio level. ESG has been integrated into decision-making for each of our alternative investments. View our sustainability approach for Real Estate, Infrastructure, and Mortgage strategies.

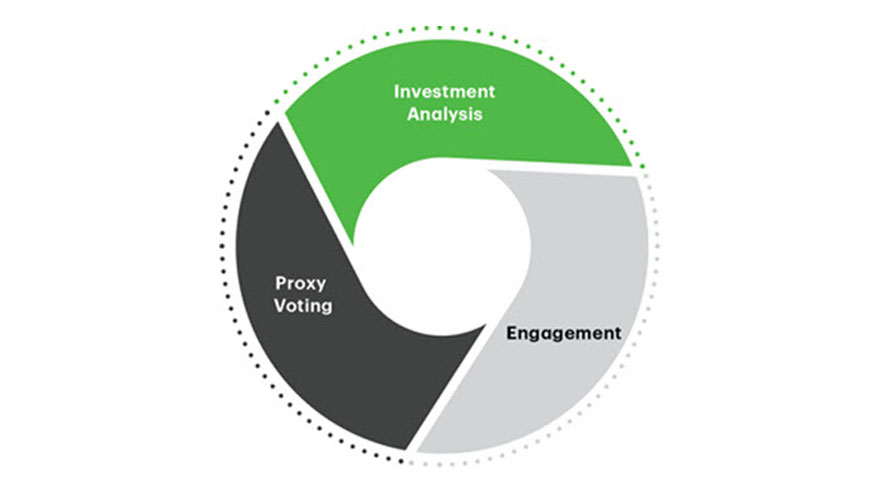

For traditional investments, our approach to assessing compant risk is grounded in three core activities:

We incorporate ESG factors in our equity and credit research We also aim to ensure that ESG considerations are part of our investment decision process.

EngagementWe engage directly and collaboratively with companies across a broad range of industries.

Proxy votingWe strive to be active owners by exercising our voting rights as shareholders. This is one of the key ways we can positively influence ESG practices for the companies in which we invest.

TD Ready Commitment

Learn more about how TD is helping to create a more Vibrant Planet

See the latest reports on TD's ESG performance and progress, as well as disclosure and position statements on important ESG topics. Learn more

Related Insights

Sustainable Investing

01/19/2018 | Podcast

Overview of ESG and TDAM's investing framework.

Quantitative Equity & Responsible Investing

01/19/2018 | Whitepaper

Decide what stance to take on responsible investing.

IMO placeholder

01/19/2018 | Whitepaper

Tobacco placeholder

01/19/2018 | Blog

U.S.

U.S.