Manage My Account

Looking for a Personal Account? View All TD Personal Accounts.

Easily manage your money

Tabs Menu: to navigate this menu, use the left & right arrow keys to change tabs. Press tab to go into the content. Shift-tab to return to the tabs.

Helps cover unexpected cash shortfalls by providing automatic protection against declined transactions.

Prevents costly Non-Sufficient Funds (NSF) charges from occurring.

![]()

![]()

![]()

Want to see how it works? Take the tour

-

Overdraft Protection

-

Pre-Authorized Debit Payments

-

Direct Deposit

-

Online

Statements

What is overdraft protection?

Overdraft protection helps cover occasional shortfalls in your chequing account, up to your approved overdraft limit even if you have insufficient funds in the account.* It helps you manage your finances by allowing you to complete a transaction.Do I need overdraft protection?

There are several benefits to having overdraft protection:Helps cover unexpected cash shortfalls by providing automatic protection against declined transactions.

Prevents costly Non-Sufficient Funds (NSF) charges from occurring.

* Subject to the terms of your Overdraft Protection Agreement.

Monthly Fee Overdraft Protection

This option is a good choice if you write a lot of cheques and use your account for several transactions. Protects you from incurring the cost of a returned (NSF) cheque, or the embarrassment of a declined transaction. The monthly fee is only $4 a month (plus interest on overdrawn amounts).

Pay As You Go Overdraft Protection

This option is a good choice if you don't think you'll have more than an occasional need for coverage. You only pay when you use it - so it's a good option if you don't have a lot of activity on your account. The most you'll ever pay in one day is $5, plus any interest on overdrawn amounts.

Overdraft protection interest rates

Overdraft protection is subject to approval and approved limits, interest rates and repayment conditions.

- First, you need to be approved for overdraft protection. Apply now – it only takes a few minutes

- Overdrafts are subject to an interest rate of 21% per annum

- Deposits are immediately and automatically applied against the overdrawn balance

- Overdrawn balances must be paid within 89 days

- Overdraft interest rates are subject to change

A convenient way to pay your bills on time

- Never miss another payment by paying your bills on time, every time with Pre-Authorized Debit (PAD).

- It’s easy to set up a PAD with most major billing companies, and payments are automatically deducted from your TD account.

Here’s how to set up a PAD in two easy steps

Step 1

Call your billing company or visit their website to find out their process for setting up a Pre-Authorized Debit.

To make it easy for you, we’ve provided a list of the most common billing companies and an outline of their current processes.

To make it easy for you, we’ve provided a list of the most common billing companies and an outline of their current processes.

Here’s how

-

American Express

Download an online form and mail in with a void cheque 1-800-869-3016. -

Bell

Create an online account. 1-800-773-2121 -

BMO (MasterCard)

Download an online form and mail in with a void cheque or bring the form and a void cheque to a BMO branch. 1-800-263-2263 -

CIBC (Visa)

Set up over the phone or in branch. 1-800-465-4653 -

Enbridge

Download an online form and mail in with a void cheque. 1-877-362-7434 -

MBNA (MasterCard)

Download an online form and mail in with a void cheque. 1-888-876-6262 -

Rogers

Create an online account. 1-888-ROGERS1 -

TD Insurance

Set up over the phone. 1-866-322-5854 -

TD (Visa)

Set up over the phone or download an online form and mail in with a void cheque. 1-800-983-8472 -

Telus

Create an online account. 1-888-811-2323

|

Company

|

Here’s how

|

|---|---|

|

Download an online form and mail in with a void cheque 1-800-869-3016.

|

|

|

Create an online account. 1-800-773-2121

|

|

|

Download an online form and mail in with a void cheque or bring the form and a void cheque to a BMO branch. 1-800-263-2263

|

|

|

Set up over the phone or in branch. 1-800-465-4653

|

|

|

Download an online form and mail in with a void cheque. 1-877-362-7434

|

|

|

Download an online form and mail in with a void cheque. 1-888-876-6262

|

|

|

Create an online account. 1-888-ROGERS1

|

|

|

Set up over the phone. 1-866-322-5854

|

|

|

Set up over the phone or download an online form and mail in with a void cheque. 1-800-983-8472

|

|

|

Create an online account. 1-888-811-2323

|

Step 2

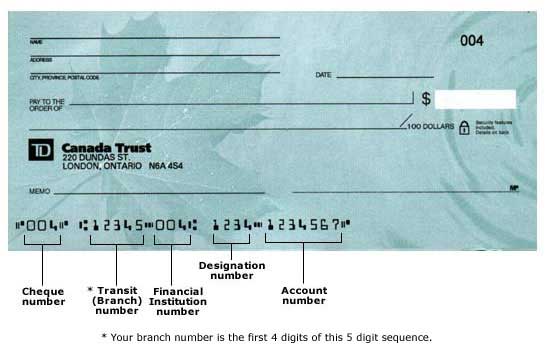

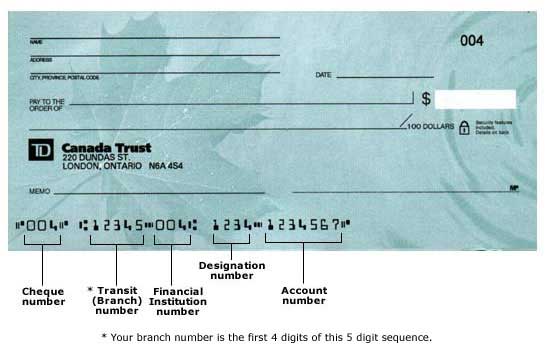

Provide the billing company with your chequing account information using:

Our new EasyWeb Online banking tool makes it faster and easier to get your Account information

- Your TD Access Card: If you have an enhanced TD Access Card and your billing company accepts Visa Debit, Pre-Authorized Debit or recurring purchases, provide them with your TD Access Card number.

- Your TD Canada Trust chequing account information: Companies may need your

Branch Transit Number, Institution Number and Account number.

Our new EasyWeb Online banking tool makes it faster and easier to get your Account information

Get fast access to your money

Get employer and government payments deposited directly

Convenient

Faster access to your money. Your payments will never be held up by postal delays or other postal delivery issues.

Reliable

Your payments will always be on time, so you’ll have immediate access to your money when you need it.

Secure

Direct Deposit is reliable and safe. Review our Privacy Policy and Internet Security to learn more about how we’re protecting you.

Set up Direct Deposit for employer payments

- Find out from your employer if Direct Deposit is available, and then select an option below to get your Direct Deposit information:

- Use our EasyWeb Online banking tool to access to your Direct Deposit information

- Download and complete the Direct Deposit form and present it to your employer’s payroll department. If you are receiving a pension, you can also present the form to your pension provider or former employer’s payroll department.

- Questions about employer payments? Call us at

1-877-247-2265

Direct Deposit for Government of Canada payments

Use Direct Deposit to reliably and securely avoid any potential postal delays with your Government of Canada payments. Here’s how to get started:

No void cheque? You can use our new EasyWeb Online banking tool that makes it faster and easier to get the Direct Deposit information you need.

Got questions about your Government payments?Call 1-800-593-1666

- Complete the Government Direct Deposit form.

- Print the completed form and mail it along with a void cheque to the address provided.

No void cheque? You can use our new EasyWeb Online banking tool that makes it faster and easier to get the Direct Deposit information you need.

Got questions about your Government payments?

Save time and stay organized

Online Statements are convenient and flexible: Get notified when your account documents are ready. It’s easy to make the change!

- Email notifications let you know that your online statements are ready for viewing

- Free 24/7 online access1 to your account documents, including TD Credit Card statements

- Access up to seven years of account history, starting from the time you register

- To switch, make sure you’re registered or log in to EasyWeb Online banking

How do I switch?

- Select Statements and Documents from the left menu, and select Delivery Preferences

- Change your eligible accounts to Online Only, and agree to the Terms and Conditions.

- Click the Save Settings button

Want to see how it works? Take the tour

Online Statements are available with:

- TD Credit Cards

- TD Personal Line of Credit

- TD Term Deposit

- TD Home Equity Line of Credit

- TD Retirement Savings Plan

- TD Registered Education Savings Plan

- TD Mortgage

- TD Personal Chequing Account

- TD Personal Savings Account

- TD Personal U.S. Dollar Account

- TD Small Business Banking Account

- TD GIC

More convenient banking options

TD Access Card

Enjoy the convenience of paying with the TD Access Card.

TD app

Available for iPhone, iPod Touch, Android and BlackBerry devices.

Ways to Save

Save automatically with our Pre-authorized Transfer Service and Purchase Plan

EasyWeb Online banking

Do your banking from the comfort and convenience of your home or office

*The TD app is free to download; however, standard wireless carrier rates may apply.

US

US