Birth of first grandchild

We have always placed a high value on education – and we wanted our first grandchild to have that opportunity.

* Not real customers. Composite created for illustration only.

You can rely on TD Wealth to provide you with open, straightforward advice to help you realize your goals whether you are just starting to save and invest or have accumulated significant wealth that would benefit from professional management.

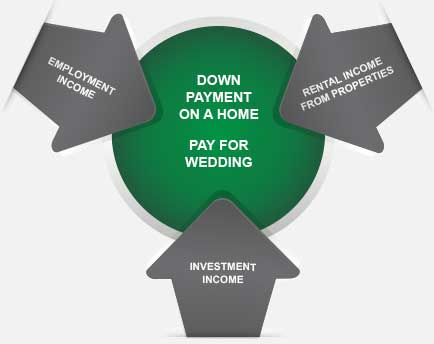

This couple needed a plan to move into a bigger home and build for the future while still enjoying family time today.

Call 1-800-577-9594 or find an advisor in your area.