Having children

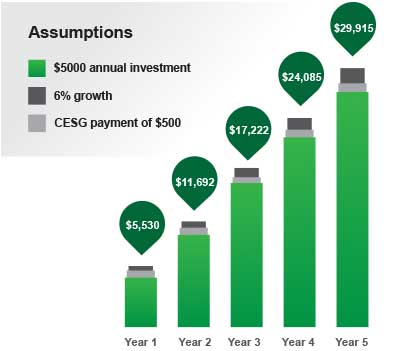

When our kids were born, our whole perspective changed. All of a sudden, the most important thing in the world was to make sure they would have everything they needed, including a good education.

* Not real customers. Composite created for illustration only.

You can rely on TD Wealth to provide you with open, straightforward advice to help you realize your goals whether you are just starting to save and invest or have accumulated significant wealth that would benefit from professional management.

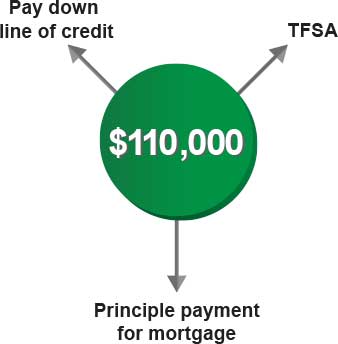

Approaching retirement, Dominique needed advice on how to support her children and lay the foundation for the retirement lifestyle she envisioned.

Call 1-800-577-9594 or find an advisor in your area.