Tax Resource Center

2017 tax returns were due April 17, 2018 (unless you requested an automatic extension by that date)

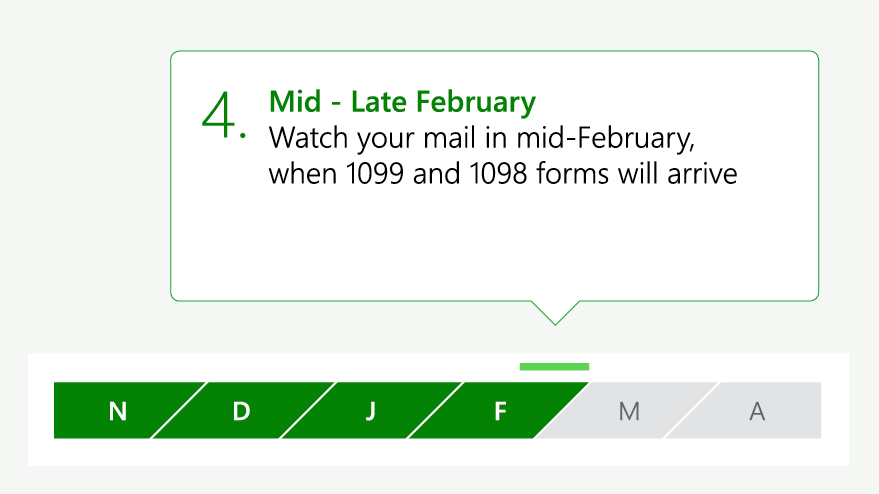

All forms were mailed in mid-February. If you haven't received them, visit us at a TD Bank store, or send us a secure message online for more information.Important dates – 2017 Tax Year

- April 17, 2018

Your 2017 tax return is due (unless you request an automatic extension by this date). - Mid to late February

Your tax forms arrive at home. - Late January to early February

Your tax forms are in the mail. - Early January

We're getting your 1099 and 1098 tax forms ready. Keep an eye out for W2s from your employer. - November to December

Double-check to make sure your mailing address is up to date.

All forms have been mailed! If you haven't received them, visit us at a TD Bank branch, or send us a secure message online for more information.

Tax refund tips

Before you splurge, consider saving your tax refund for the future.

Did you know? Americans only save 5% while experts recommend 3 times that amount to ensure they have enough for emergencies, retirement and a rainy day.

Thinking about retirement? An IRA is a great place to start.

View all TD IRAs

Just getting started? Here's the perfect savings account for you.

TD Simple Savings

Need an emergency fund or saving up for a big purchase? Maximize your savings with these accounts:

Calculators, tools and guides

Calculators

Tools and guides

Videos

Canada

Canada